- Trusted by Investors Worldwide

Unlocking access to investing

The world’s best financial institutions in a single, simple, and flexible solution that’s accessible to everyone

Supported by trusted global institutions ensuring security and compliance

Guernsey Domiciled

Investment Advisor

Capital Protection

Global Custodian

Invest Smartly

Key Features

Active Portfolios

Index Trackers

Thematic Funds

Capital Protection

Governance

Flexibility

- Web & Mobile Access

- 24/7 AI Support Agents

- Dedicated Expert Support

Single and Regular Contributions

Single Contribution from US$10,000 and Regular Contribution from US$250 per month.

-

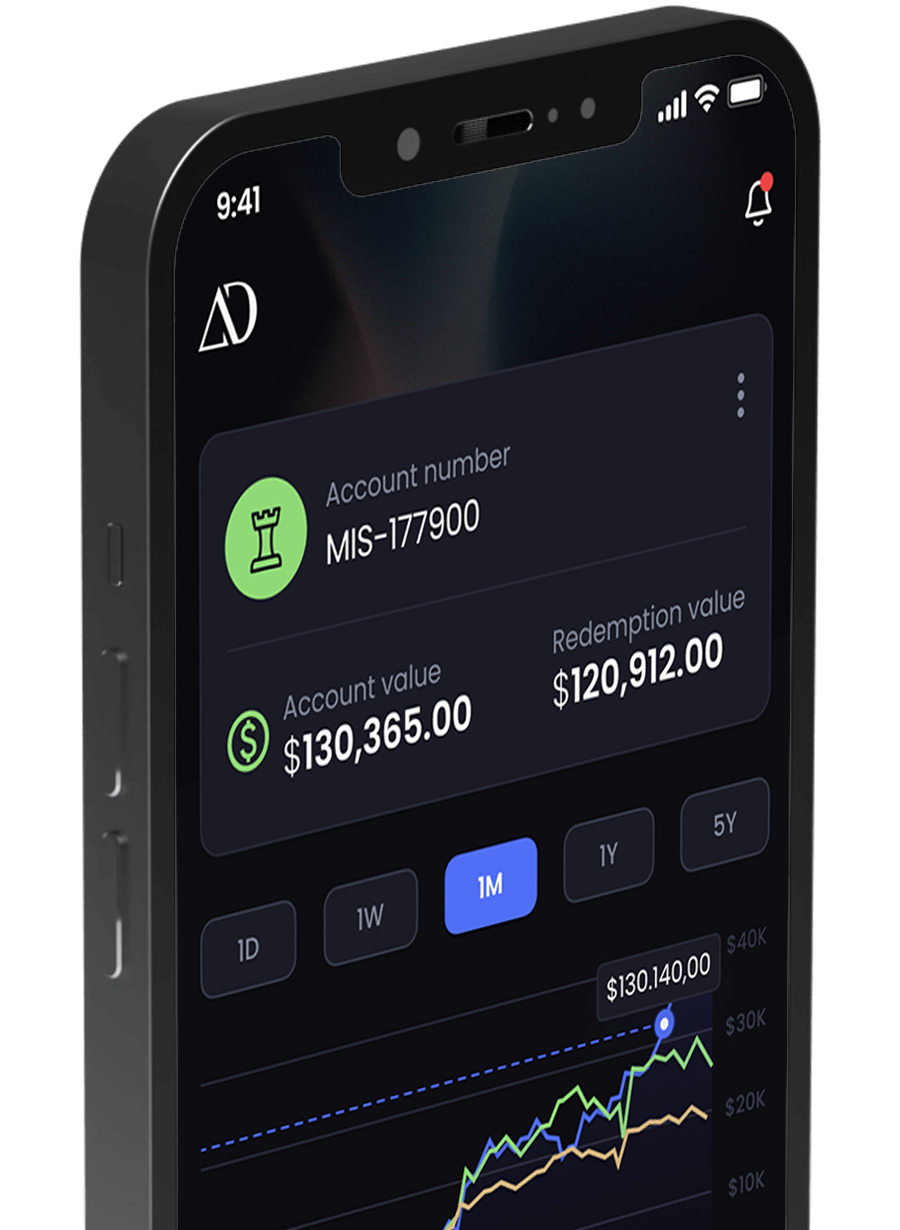

100% online application process and administration providing for 24/7 access to each investor's individual portfolios.

-

Domiciled in Guernsey, a premier, well regulated financial services centre.

-

Free choice of beneficiaries' designation ensuring your investments benefit the people they are meant to.

Actively Managed Portfolios

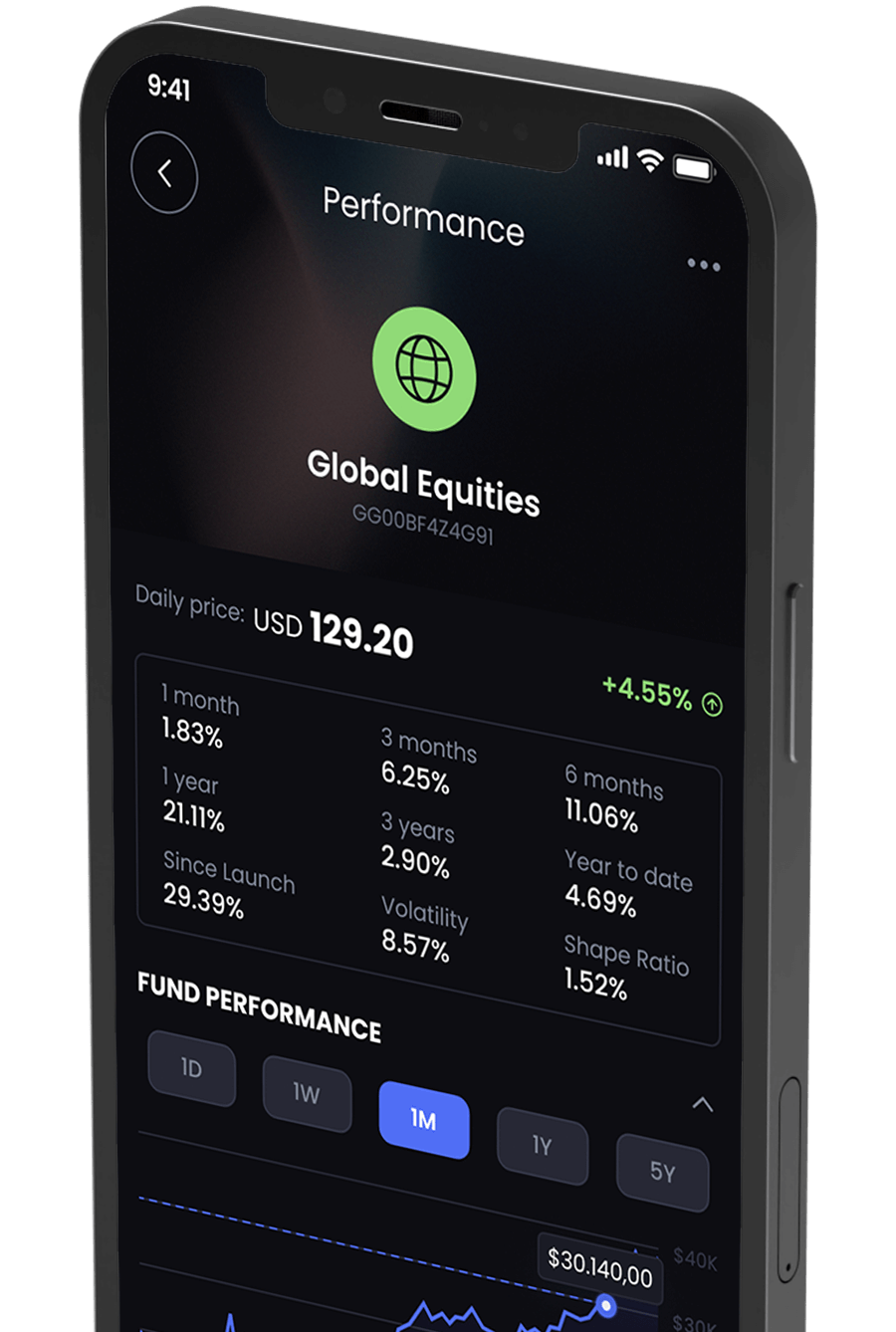

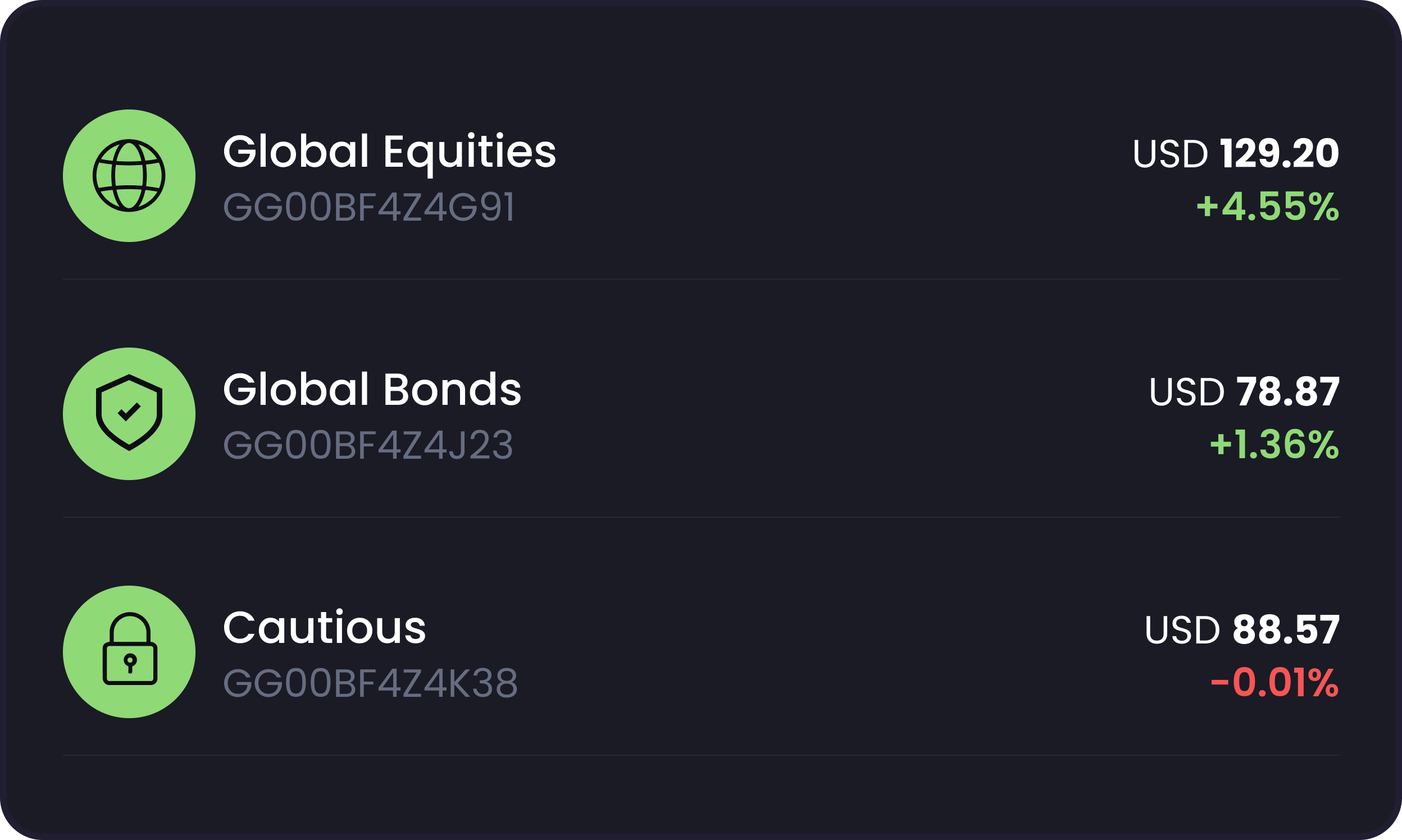

You can freely select from our range of funds, opt for an actively managed ABC strategy, or choose a capital-protection layer on a fund such as our S&P 500 Tracker.

-

Access to institutional fund share classes and ETFs from internationally recognised fund managers.

-

Our strategies are designed for all risk profiles, depending on short, medium, and long-term objectives.

-

Diversification of assets is a priority in order to maximise returns and reduce volatility in each strategy.

How it Works

Opening a Dominion account is fast & simple

01

02

03

04

FAQ

Frequently Asked Questions

Clear and concise answers to help you navigate your investment journey.

Dominion is a innovative fintech investment platform that makes global investing simple. We help you grow your wealth through professionally managed portfolios, built with Funds managed by best in class fund Managers, top-tier custodians, and daily liquidity—all accessible from a single account.

You’ll open your Dominion account through an independent financial adviser. They’ll help you define your goals and select the most suitable investment strategy.

Typically, you’ll need proof of identity, proof of address, and some information about your source of funds and wealth. Your adviser will guide you through the exact steps.

Your investments are held in segregated accounts with Bank of New York Mellon, one of the world’s most secure global custodians.

Our optional Protected Investment Portfolio (PIP) add-on, developed with FNZ, offers downside protection of up to 80% of the highest value your fund shares reach—while still allowing growth if markets go up.

Yes. You can request a full or partial redemption at any time. The value of your redemption will be based on the number of fund units you hold, excluding establishment units, as explained in our Terms & Conditions. Redemption proceeds are generally paid within a few business days after processing.

For savings accounts, please keep in mind that an early redemption may result in receiving less than the total amount you have invested. We recommend considering this carefully when choosing your savings term or before requesting an early redemption.